Organizations that unite often face tough choices. These decisions affect the people, processes, technology, and operations on both sides — and without clearly-defined priorities and buy-in, mergers and acquisitions (M&As) are destined for failure. In fact, 70 to 90% of all acquisitions do not succeed.

Challenges associated with M&As impact every aspect of the new organization formed by the target and acquirer. Between cost impacts, the integration of disparate systems, and the tendency to underestimate time and effort, achieving a successful M&A can often feel impossible.

M&As are arguably even more difficult for the people involved. In addition to balancing two distinct company cultures and histories, executive leaders and management must make a number of taxing decisions, such as which staff will stay, who will go, and how roles might change. Existing staff sometimes step in and assume this burden, believing they can be neutral parties — but this only exacerbates the tricky circumstances team members are faced with, as well as pulling them away from their true roles.

All this upheaval and uncertainty puts a significant strain on employees, negatively affecting their engagement and productivity. To make matters worse, disorganization during M&A dashes hopes of a successful and seamless union. Meanwhile, organizations make immediate results and visible ROI a priority, to the detriment of team morale.

It is incredibly hard for merging organizations to connect the dots. If done haphazardly, M&A can damage a company’s revenue and dampen its spirit. Acting as one unified organization requires a clear understanding of the roadmaps ahead, with pathways rooted in alignment and mutual understanding. Failing to plan is a plan to fail.

What It Takes to Lead A Successful M&A

M&As are more popular than ever. After hovering around 50,000 for the past 17 years, the number of M&A transactions shot up to 63,215 in 2021 — and the value of these global deals totaled nearly six trillion USD. Despite the increase in M&As, they are no less mismanaged and misunderstood.

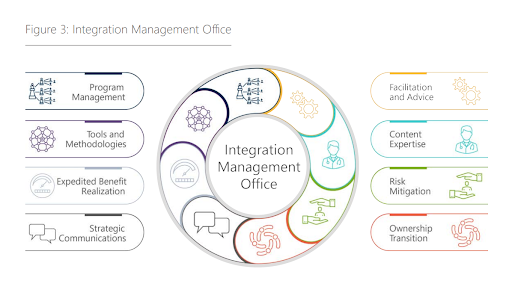

Many companies turn to an Integration Management Office (IMO) for help leading a successful M&A. An IMO is a governing body that gives organizations proper authority to ensure a smooth, efficient, and long-lasting unification. Organizations that use an IMO can coordinate and balance individual teams and systems to prioritize the right approaches and help everyone apply best practices. An IMO also assists organizations in tracking their progress and ensuring the standardization of chosen processes, creating a foundation for longevity and adaptability.

An IMO leverages many valuable tools for organizations going through M&A:

- Data and Gap Analysis — An IMO helps organizations analyze data to understand how each unit managed data prior to the merger or acquisition. What systems did end-users leverage, avoid, or not even know existed? This process also helps stakeholders identify any regulatory and compliance issues.

- Current vs. Future State Assessment — When companies combine, they often have duplicative solutions and situations. An IMO helps organizations build out a roadmap deciding which elements to keep and which to remove.

- System Integration or IT Diligence — Organizations can use an IMO to create a checklist covering a host of decisions, then assess and analyze all the approaches to determine which is most beneficial. This aids portfolio management, promotes product functionality, and ensures best practices are put in place.

Integration Playbook — An IMO Integration Playbook captures all the above, allowing organizations to outline and comprehend all these M&A elements. An Integration Playbook could be hundreds of pages long, clearly spelling out each relevant item.

Change Management and M&A

Even when utilizing an IMO, organizations must ensure that people are not lost in the shuffle; otherwise, the merger is certain to fail. Resistance is a normal human response to change, but employees disengage even more during the M&A process when they are not a part of the solution. Instead of feeling like active participants in an exciting future, it feels like change is being forced upon them.

It’s also important to ensure employees know both how and why new systems are put in place. Neglected employees will fall back on legacy systems and old ways of working, forced to navigate operational changes alone. But when workers truly understand why new organizational changes exist, they feel empowered to use these tools and systems — and utilize these elements in the best ways possible for maximum gain.

The IMO will outline critical change management tasks for institutions undergoing M&A, including establishing workshops, conducting surveys, providing training and documentation, and instilling a sense of empowerment that promotes morale across the team. After all, the ultimate goal of a merger and acquisition is to produce a harmonious, unified team.

SEI Case Study in M&A

SEI has first-hand experience guiding organizations through successful M&A, even in areas with particularly complex mergers like the healthcare sector. For example, when a leading developer of dialysis treatment therapies and machinery merged with another key industry player, they experienced many alignment struggles. Procedure contracts, supply chain logistics, new project roadmaps, and go-to-market strategies were all in flux.

SEI established a week-long technology summit that invited employees from both companies to share their knowledge and research on existing processes. This workshop united the disjointed teams, promoted transparency, and established organization-wide goals and priorities. As a result, staff members were able to identify the best tools and techniques to use going forward. They streamlined processes and fostered a culture of collaboration — one that yielded a more extensive digital transformation and telehealth strategy.

Master Your M&A with SEI

At SEI, we know every organization is unique. Combining two individual companies can be a seemingly insurmountable challenge, which is why we take a holistic approach to new M&As. This helps our clients understand the union from all sides, across all business units, supporting effective and sustainable problem-solving at any scale.

By emphasizing the inclusion of all relevant stakeholders, SEI helps ensure everyone feels empowered to be a part of the new opportunities M&As offer organizations. Our expert consultants can help you leverage an IMO, or another strategy of your choice, to identify significant roadblocks and seamlessly resolve short and long-term goals.