For some time, I’ve been looking for one “source” that curates modern takes on HR Tech, perspectives from the people who build it, and its impact on enterprise — something that’s tailor-made by professionals for decision-makers.

I never found it — so I decided to build it.

Every week, I’ll be sharing fresh insights on tech platforms, design, data, and the future of work — straight to your inbox.

My Thoughts

Happy New Year! I hope everyone had a wonderful holiday – we’re back with all the Exit Interview content you’re craving!

This week marks not only the first Exit Interview of 2022, but the first edition to include a new long-form piece instead of the traditional weekly recap of HR topics. This week, Changing Workplace will examine a COVID mitigation alternative that is quickly gaining steam as the Biden administration’s vaccine mandate continues to face legal challenges. I hope the insight provides you with a better understanding of how you can use established workplace legislation to protect the health and safety of your teams.

Market Moves

The unofficial category of “stay at home” stocks has seen some volatile activity in the past few weeks despite Omicron’s surge across the US. Conferencing and hybrid work companies, which were praised 🙌 as the future of work throughout 2020, took a nosedive last quarter as intent to return to offices increased. Zoom, whose shares rose 400% in 2020, has seen its stock price drop by nearly 56% over the past 6 months. 📉 😬

This trend isn’t limited to organizations in the hybrid work industry. Experts are now speculating that the telehealth industry ☎️ 👩⚕️ is on uncertain ground, claiming that what was once considered a breakthrough in accessible medical care is now a bubble that has burst. Teladoc, the largest provider of virtual healthcare, saw stock performance rise 141% in 2020, only to come careening back to earth as share prices dropped 52% in 2021.

While still lower than their golden hours, pandemic-era stocks including Zoom, Teladoc, Peloton, and Chegg did see significant stock rises in the first week of December, when the Omicron variant was first detected in the US. Are they going to rebound completely? We’ll be keeping a close eye on them. 👀

Tech Innovation at Work

‘Tis the season for family, good food, and… cyberattacks? 🖥️The UK-based cybersecurity company Darktrace reports that ransomware attacks occurring in November and December have increased 30% in the past few years. Here are some of the unlucky few that reported having a very “hacky” holiday season:

- Kronos: One of the largest payroll providers 💵 announced that several of their programs had been taken offline by a ransomware attack just a few days before Christmas. In the aftermath, hundreds of organizations have been left scrambling to adopt manual payroll workflows, including handwritten timecards and paper checks. In a blog post, chief customer and strategy officer Bob Hughes reported that it would likely be several weeks before the programs were up and running again.

- Ubisoft: Video game company Ubisoft announced that unknown actors had targeted one of their most popular franchises, Just Dance 💃 resulting in a data breach. Ubisoft reported that the breach was limited to “Technical Identifiers,” like Profile IDs as well as videos uploaded to the in-game community. The misconfiguration that allowed for the breach was able to be fixed immediately, with Ubisoft recommending that all users reset their passwords.

- Shutterfly: Shutterfly 📸 a platform where users can store photos, order prints, and design customized products, announced last week that they had been hit by a ransomware attack by the Conti ransomware group, who are demanding several million dollars in ransom. Screenshots released by the group indicate that the stolen data includes, “legal agreements, bank and merchant account info, login credentials for corporate services, spreadsheets, and ‘what appears to be customer information, including the last four digits of credit cards.’” Shutterfly has hired third party cybersecurity experts and is currently in negotiations with the Conti group.

If a video game, a payroll company, and a website that will print your face on a bean bag chair aren’t safe from cybercrime, it’s time to admit that your organization probably isn’t either. If you’re looking for some tips for keeping safe in 2022, here’s an article from a fellow Forbes Council member to get you started.

Those anxiously waiting for 5G will be disheartened 😕 to hear that AT&T and Verizon have agreed to a new, two-week delay of their C-Band spectrum deployment, the next frontier of hyperfast connectivity. 📱 💨 The carriers, who won the spectrum at auction last year with a bid of $80 million, have been working closely with the FCC and FAA following warnings from Airbus and Boeing ✈️ that the 5G frequencies could cause interference with aircraft systems. Both companies had previously agreed to delay rollout by a month to January 5th. However on December 31st, U.S. Transportation Secretary Pete Buttigieg and FAA Administrator Steve Dickson requested that the companies push back 5G rollout another two weeks, allowing time for aviation and government officials to implement safety precautions. As of Monday, both companies have agreed to pause 5G efforts until January 19th.

The Changing Workplace

Moving into the new year, it appears that grocery chain Kroger has run out of “carrots,” 🥕 opting instead for “sticks” in order to encourage employees to get vaccinated. As of January 1st, the company announced that it would be ending emergency paid leave for unvaccinated employees who contract COVID-19. In addition, a $50 surcharge would be added to company health plans for unvaccinated employees who were salaried or nonunion.

I specifically singled out Kroger so I could make that joke, but they are far from the only employer to be testing out this approach to mitigating COVID risk in their organizations. In August, Delta Air Lines 🛩️ released a memo stating that unvaccinated employees would now incur a $200 monthly surcharge for company healthcare plans. JPMorgan is taking a similar route, upping the ante by banning business travel. Nevada 🏜️ voted in December to become the first state to enact a health insurance surcharge for public employees and their dependents who are unvaccinated.

The first question many people ask is, is this even legal? 🤔 The answer is a resounding yes. 👍 The Equal Employment Opportunity Commission clarified in an October Update to their pandemic guidelines that financial incentives are a legal option for employers to encourage employee vaccination. One NPR Business article succinctly explains it thusly: “According to federal law, companies are allowed to charge employees different amounts for health care as long as they do it through a program designed to promote healthy behaviors and prevent disease.” Wellness programs are overseen by multiple government entities, including the EEOC and ACA, to ensure program policies don’t violate HIPAA regulations or workplace discrimination laws. While the common goal is to help employees stay healthy, initiatives vary widely, from reimbursing gym memberships 👟 💪 to hosting in-office flu shot clinics to offering bonuses to employees who participate in mindfulness programs. 🧘🏿♀️

Even if it’s legal, does it actually work? 🤔 🤔 🤔 Though the data is still emerging, research is indicating that it does — and it’s incredibly effective. Delta has reported that, after the surcharge was implemented, the vaccination rate among their 73,000 employees reached a stunning 94%. 😮

Health insurance surcharges aren’t the only financial incentive options. JPMorgan 🏦 has implemented a new fee for unvaccinated employees to cover the costs associated with weekly testing. Mercyhealth, a Michigan-based healthcare provider, 🏥 chose to establish a “Risk Pool” into which unvaccinated employees are required to pay a monthly fee ranging from $60 to $265, based on salary. In a memo to employees, Mercyhealth Marketing Director Kristina Decoster introduced the program by saying, “a corollary example is 16-year-old drivers having to pay higher insurance costs because they make up a higher risk pool for losses to the insurance company.”

One month after the policy was enacted, Alen Brcic, Mercyhealth’s vice president of people and culture, was proud to report that employee vaccination rates had risen from 70% to 91%. This example in particular is one I find incredibly impressive. While the efficacy of the program lies heavily on the financial incentive, there is no doubt in my mind that its tactful and relatable delivery played a significant role in its success. 🏆

Of course, implementing any type of wellness program is not without its stipulations. When it comes to legal compliance, there are two major points to be aware of when developing your program:

- Incentives have caps: Pursuant to Public Health Services (PHS) Act 2705 (the relevant contents of which can be found in this much shorter 2021 press release), the maximum reward (or penalty, such as a surcharge) for a health-contingent, activity-only wellness program may not exceed 30% of the total cost of coverage. Additionally, the total cost to the employee including the surcharge must still be considered “affordable,” as defined by the Affordable Care Act. More on how to calculate that here.

- Reasonable alternatives must be available: although the point of such a wellness program is to get employees vaccinated, you are required to provide an alternative method for employees to receive or avoid the financial incentive. Per current requirements for all health-contingent wellness programs, an alternative must be offered if it is “unreasonably difficult due to a medical condition,” or otherwise medically inadvisable for an employee to achieve the standard laid out in the wellness plan. It is legal to seek physician verification when employees request the alternative method. However, given the tense opinions surrounding the COVID vaccine, many employers are choosing less extreme requirements for employees to be eligible for alternative methods, such as completing a vaccine education course.

And of course, once you’ve designed your wellness program, the next step is implementing it. For inspiration, I’ll once again point you back to the immaculately executed Mercyhealth memo. And for more comprehensive direction, here is a step-by-step guide to creating an employee wellness program from SHRM.

All About Data

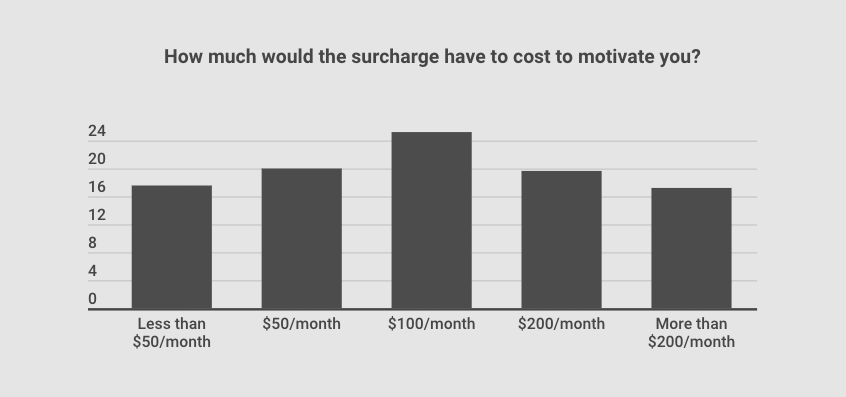

If you’re trying to decide what sort of financial incentives to implement into your COVID-prevention wellness program, Affordable Health Insurance has released a report digging into what (and how much) is proving to be effective motivators for employees. Here are the highlights:

Like I said, financial incentives don’t have to be surcharges:

- 36.6% of surveyed employees said they would definitely get vaccinated to avoid a workplace mask mandate

- 37.9% of surveyed employees said they would definitely get vaccinated if they couldn’t receive paid time off for quarantining after a positive COVID test.

Click here to subscribe to Exit Interview, a weekly email about tech platforms, design, data, and the future of work — straight to your inbox.